How do you best monitor that your payment process is working as expected? After all, it’s never a good idea to wait for your customers to inform you about purchasing issues – there simply is no business without a functioning payments system. So, did you know that with Flows you can make sure you have all checks and automated alerts in place?You can set up alerts easily in just minutes as well as customised triggers based on certain Errors and payment providers. You can also connect to all 3rd party payment platforms instantly using Flows app marketplace to collect all the information you need quickly and easily.

From abandoned and failed deposit Flows with alerts and automated customer messaging, to automated reporting and failure and success counts with percentage calculation for each provider and GEO, it really is that simple, ‘Just Flow it! And that’s not all you can do, why not take it a step further and build specific payments KPIs per market, GEO, segment, and payment provider. It’s all possible with Flows!

And, if you are looking for real-time tracking of VIP deposits? No problem. What about real-time whitelisting requests to payment providers? You got it! And a Morning report with the previous days payment statistics? Flows has you covered!

So, how do you Flow it?

Can I create Flows for different segments?

Of course you can, just add in all the variables for your segment in a “route flow” stage to filter through your data – and only those that match will pass through the green path. You can also use our App marketplace to instantly connect to your platform and collect the segment from there.

In this Flow of the week we start our flow on any deposit event, we then create one route for Failed and another for successful deposit. In our example this week we want to exclude first time depositors – and have a separate flow for them. So in this Flow we route on failed deposits for those who has had at least 1 success before, and on successful deposit we route on those that had at least 1 successful before this Flow event. You may also filter on country, payment provider, payment type or any other data fields you have available in the event or from your platform.

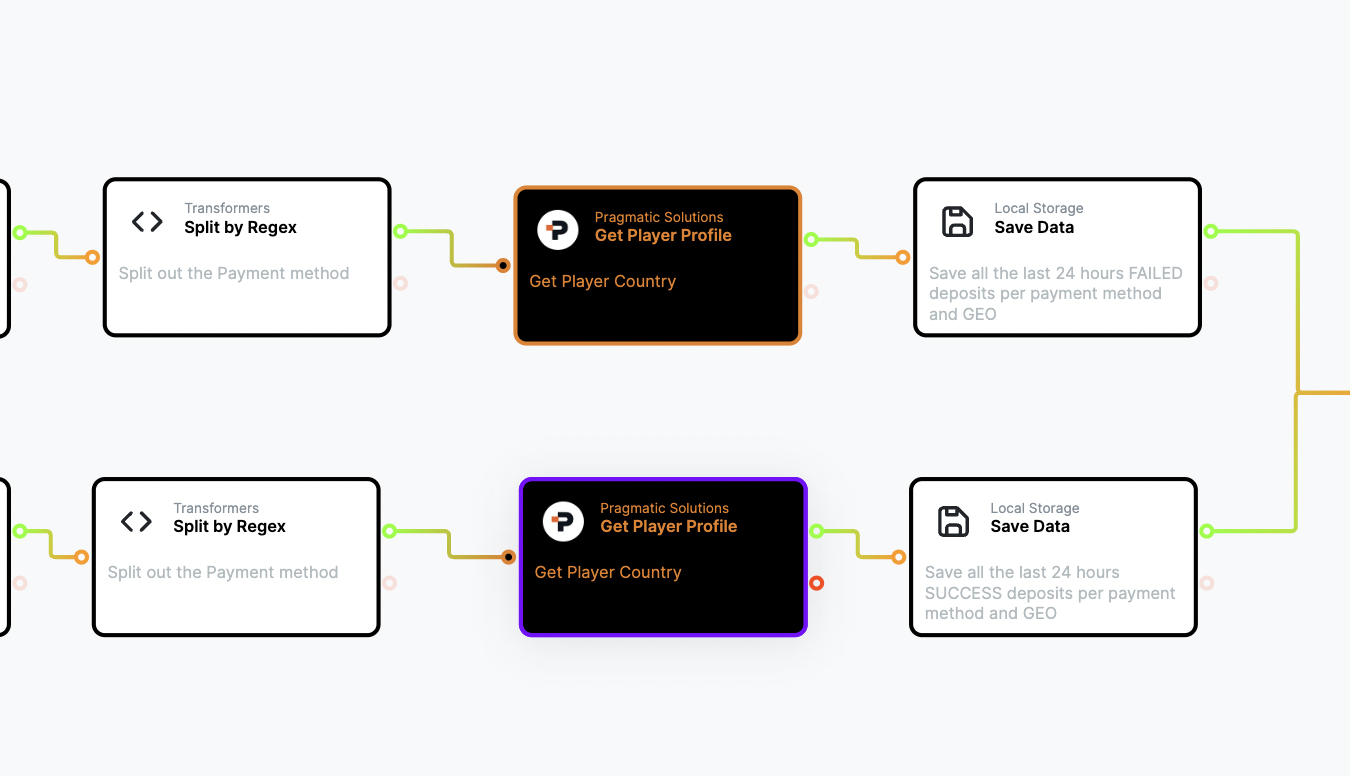

We continue our Flow by splitting out the different payment providers to store the KPIs per payment provider and GEO in our example. We do that easily by saving the data using the variables for payment provider and GEO as headers – so the failed and success deposit count and sums are only stored on the provider and Geo headers that match.

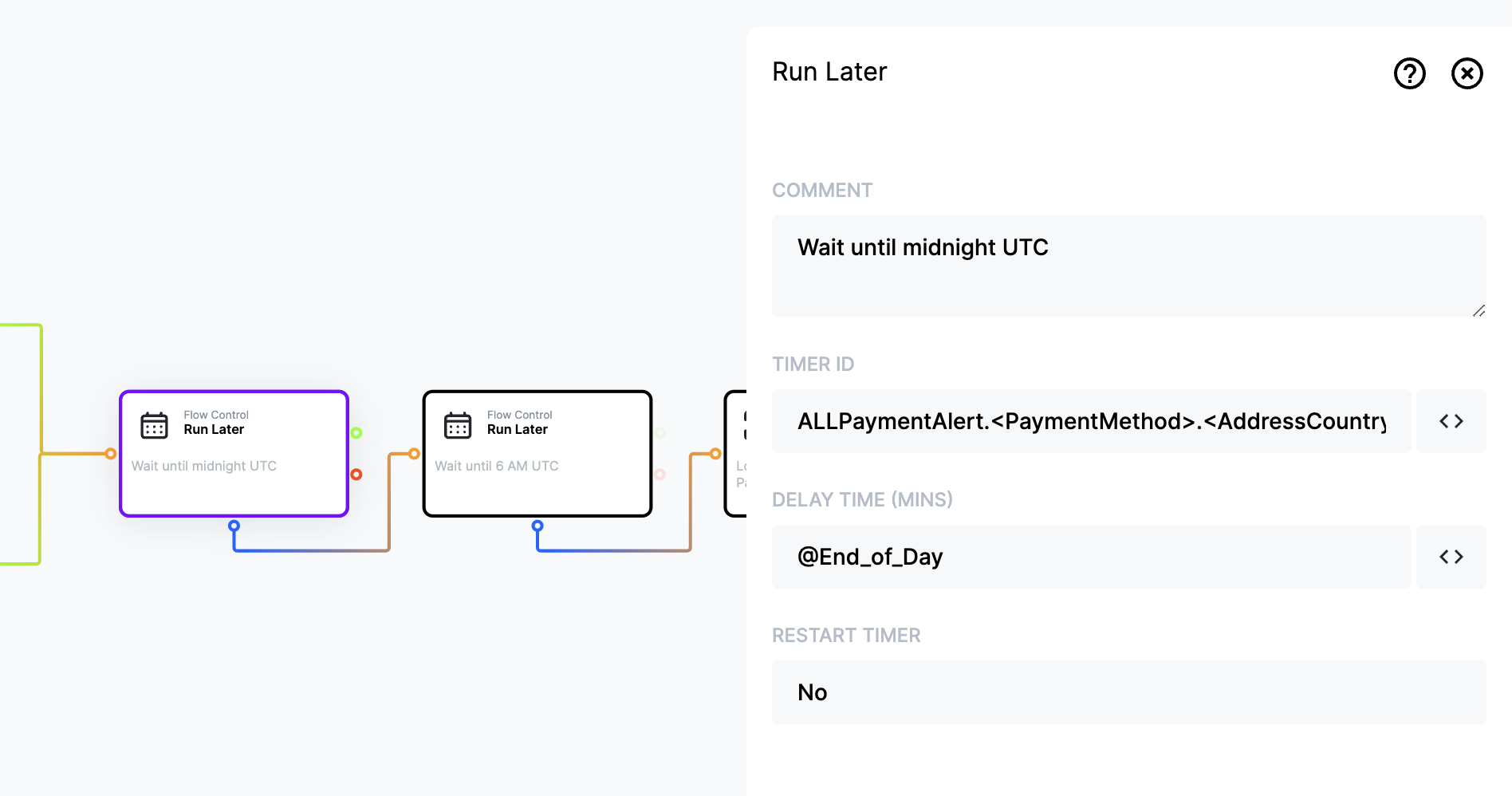

One great functionality in Flows is our wait stages – use our “Run later” to ensure that the reporting or alerts run at the time you wish to receive them. In this example we have two of these stages to set an exact time – one that runs the blue path at midnight UTC and another that continues after 6 hours. This means that the following stages will run on the next day at 6am UTC. The stage is set in minutes to give full flexibility to be used in many different flows and use cases. In Flows you will find different quick functions such as “@start_next_month” or “next Monday at 6 am” so the minutes until then is automatically calculated at the time of the flow stage being run.

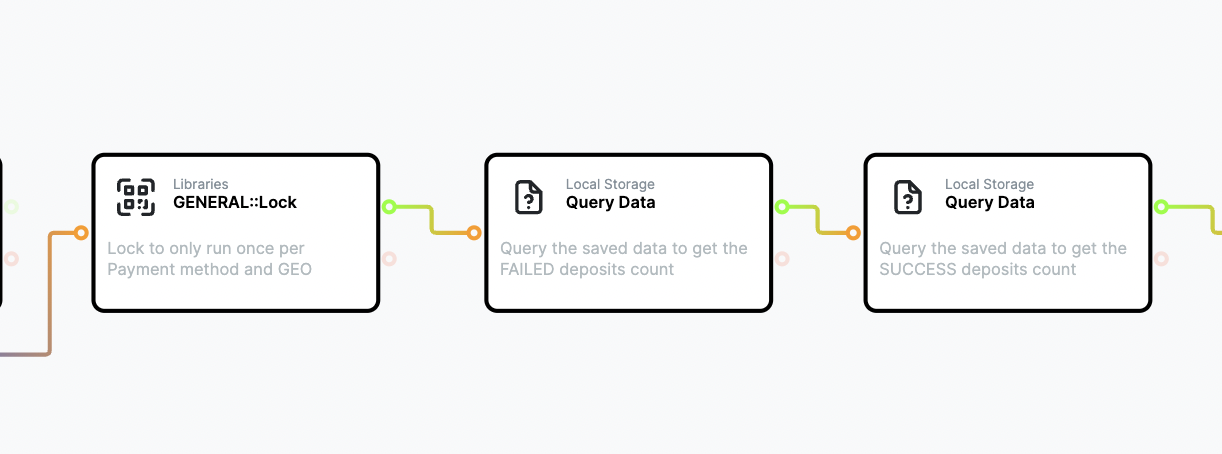

The Flow now continues with a lock so that we don’t get one row per user deposit (per event), instead we only want one row per payment method and Geo. You can easily select what to lock on. The Flow then follows with a query of the data that has been saved during the timeframe we set in the save stage at the start of the flow. We here need two querys – one for failed deposits and one for successful.

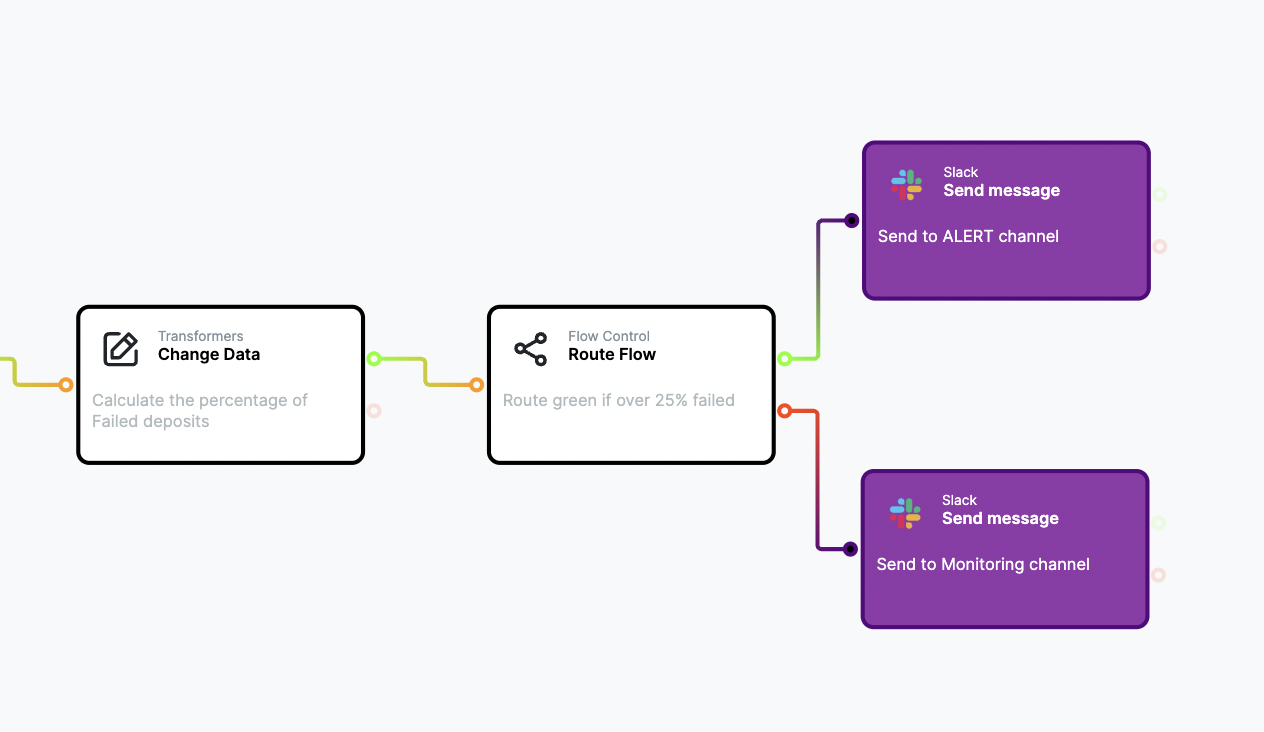

Once we have queried our data, Flows will give you the sum, count, maximum and minimum values in your data storage. We then continue our Flow of the week by changing this data and create new KPIs for Failure percentage and Success percentage. This can then be stored in reports as well as in our example – send a list for monitoring and a separate one for alerts for priority action. All based on the failure percentage per payment provider and country – or whatever variables you wish to have separate KPIs for! Build them quickly and easily using Flows.

Flows – Supercharge what you have and build what you don’t

If you want to find out more about how flows can help you to accelerate delivery and supercharge your innovation, get in touch

back to blog

back to blog